A New Doctrine for Israel

The notion of a national security doctrine is usually associated with the foreign policy of hegemonic powers, particularly the United States. Several American presidents have either promulgated a doctrine or had one named after them. A doctrine is usually understood as encompassing economic, geopolitical, and even social objectives, as well as the policies to attain those objectives.

Although we tend to associate the notion of a doctrine with hegemonic powers, we can also attribute doctrines to small and medium-sized states. Their doctrines are not so much about changing the world order but rather about responding to changes in local and regional circumstances and in global tectonic trends. In the case of Israel, it would be safe to argue that the country’s first prime minister, David Ben-Gurion, had a national economic-security doctrine. As a leader of Israel’s labor movement, chairman of the Jewish Agency, and prime minister, he played a key role in shaping Israel’s economic-security strategy during its formative years, the contours of which I will discuss below.

Since the early 2000s, a new national economic-security doctrine was consolidated by center-right elements in the Israeli political system. Benjamin Netanyahu, first as minister of finance and then as prime minister, played a key role in shaping what I describe as the transition from the financial dependency doctrine of Ben–Gurion to a financial independence model, which allows for a more independent foreign policy.

Reliance on Foreign Capital Under the Ben-Gurion Doctrine

Looking at the economic history of Israel, there was one phenomenon that has constantly occupied the leadership: the need for foreign capital. Since the origin of Zionist settlement in Palestine in the 1880s, the question of financing the national project was just as critical as the territorial issues. Initially, the funds were delivered to sporadic Jewish settlements as tutelary philanthropy. In the first half of the 20th century, the World Zionist Organization and the Jewish Agency for Palestine channeled capital from world Jewry to Palestine’s Jewish community, especially to the labor movement. During the first two decades after the establishment of the state in 1948, although the US and the Jewish diaspora provided foreign capital, reparations from West Germany were the main source of capital. Overall, the state-building process was heavily dependent on the financial support of liberal-democratic Western powers.

The reliance of Israel on foreign—Western—sources of capital was part of Ben-Gurion’s economic-security doctrine that was consolidated as early as the 1930s. Ben-Gurion believed the that the destiny of the Jewish state in Palestine would be determined by demography. However, the creation of a Jewish majority in Palestine required rapid industrialization rather than gradual economic growth. Rapid industrialization could not have been achieved without foreign capital. Therefore, the dependency of Israel on Western capital—either from Germany, from the US or from the Jewish diaspora—was a key pillar in Ben-Gurion’s doctrine. Over time, this principle had become part of Israel’s national identity.

The reliance on foreign capital made Israel—like many other small emerging economies—a vulnerable territorial being. Dependency was often framed as an asset and sometimes as a liability. During the 1970s, Israel went through a rapid process of armament financed by US economic and military assistance. During this period, Israel built its military power and became a regional power at the cost of deepening its dependence on the US and growing foreign debt. Israel’s vulnerability was manifested a few years later, when the changing circumstances in the Middle East led the US to curb and condition its assistance to Israel. After several years of a growing crisis, in 1985 Israel faced an existential debt crisis: It was no longer able to finance its foreign debt. Eventually, Israel received an assistance package from the US, but only after the government approved and implemented a tough stabilization plan, which included cutting the defense budget.

The stabilization plan demonstrated the fundamental tradeoff that many small economies face: prioritizing economic autonomy that enable the state to address domestic socioeconomic objectives at the cost of growing external vulnerabilities and dependencies; or prioritizing the state’s external power by lowering vulnerabilities and dependencies at the cost of undermining its capacity to respond to domestic socioeconomic conditions. It is sometimes possible to escape this tradeoff between autonomy and sovereignty, if the international environment accommodates it.

During the 1990s, there was a narrow and short-lived window of opportunity to escape this tradeoff. It was assumed that if the Middle East became a more stable region, capital would flow in, exports would flow out, and the cost of defense would decrease. In such circumstances, the tension between autonomy and sovereignty would subside. This vision of a new Middle East implied that Israel would no longer be an isolated liberal democracy in the Middle East but would rather be at the epicenter of a new regional market. The Israeli economy would benefit from access to new global markets, including Arab countries. To ensure a smooth transition, Israel would receive full US economic and political support.

Israel had a taste of this vision during Rabin’s government. The center-left government privatized state-owned-enterprises and liberalized trade, but it also increased investment in health, education, and infrastructure, especially in the country’s geographic periphery, where new immigrants were settled, and in Israeli Arab communities. During Rabin’s government, inequality levels in Israel fell and real wages increased. The peace process was a necessary precondition for the success of this strategy. It opened new markets for Israel products, and it turned Israel into a potential investment target for the expanding global financial markets. In addition, the peace process was consistent with US interests in the region, and Israel was handsomely rewarded and supported. Rabin’s government brought Israel as closer as it had ever been to the European social-democratic model.

For a moment, the 1990s were the dawn of a new era. Israel seemingly was able to overcome the small states’ fundamental policy dilemma between economic autonomy and external sovereignty. Rabin’s government represented a potential end of the Ben-Gurion doctrine, which prioritized economic autonomy at the cost of dependency.

A New Doctrine

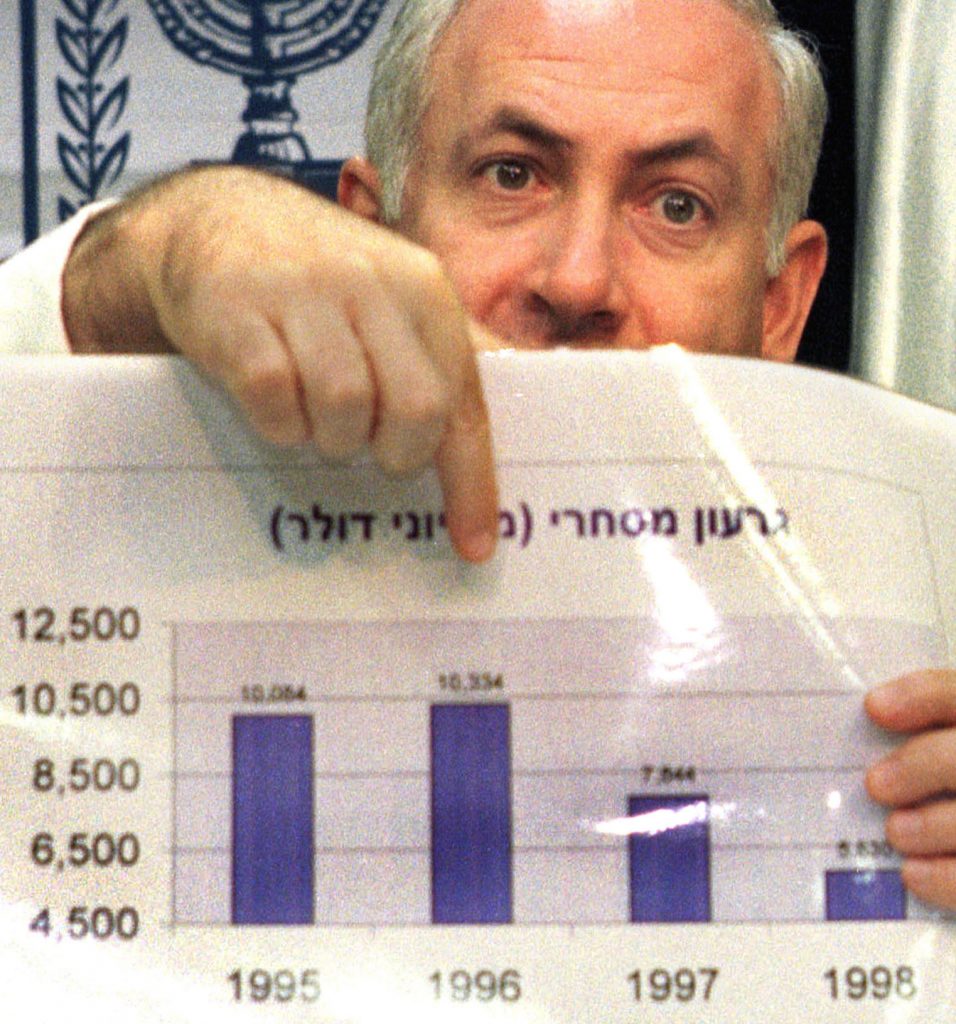

The outbreak of the Second Intifada in September 2000 turned the game upside down. The failure of the Camp David Summit in that year marked the end of the peace economy. The right-wing governments in the post-Intifada period faced a new dilemma: How to restore economic growth without a peace process? This dilemma was the origin of a new economic-security doctrine.

In the early 2000s, the Israeli economy was in a recession, caused by the outbreak of the Second Intifada, the global market collapse known as the “dot.com crisis,” and the 9/11 terror attacks. The government of Ariel Sharon, led by Finance Minister Benjamin Netanyahu, implemented an austerity policy. In April 2003, a month after his appointment as minister of finance, Netanyahu announced the Economic Recovery Plan, which included a budget cut, a lowering of government deficits, and severe reductions in social spending and allowances. He also reduced government subsidies to the private sector.

For Netanyahu, private sector growth was a means to improve Israel’s economic power in a globalized world. Whereas Rabin’s government perceived privatization and liberalization as part of a peace dividend, for Netanyahu—and for the right-wing governments in the post-Second Intifada period—privatization and liberalization were processes designed to improve Israel’s capacity to withstand external political pressure and pursue an independent foreign policy.

Some economists hailed the Netanyahu reforms, whereas others—particularly at the Bank of Israel—thought they were responsible for the growing rates of poverty and inequality and for underinvestment in infrastructure.

By late 2003, Israel’s current account had become positive and was growing, indicating that foreign currency was pouring into the economy. This change, which went unnoticed by the Israeli public, was nothing less than a transformative moment, a revolution in Israel’s economic history. As I explained above, Ben-Gurion’s doctrine assumed dependency on foreign capital. This dependency, I argue, was a key element in the national vision and identity: the dependence of the state-building project on foreign assistance. By becoming a “surplus country” for capital flows meant that more foreign currency was entering Israel than leaving it through nonfinancial transactions. Israel had become less vulnerable than it had been before.

The Bank of Israel hoarded part of the foreign currency. The Bank of Israel’s foreign reserves, having rocketed since 2007, currently are among the highest in the world per gross domestic product. At the same time, despite the deadlock in the peace process with the Palestinian Authority, Israel’s risk premium on government bonds stayed low and matched the risk premium of some countries in Europe.

From the perspective of foreign policy, the termination of the peace process and the strengthening of the economy led Israel to take a unilateral approach to the conflict. This approach included the withdrawal from Gaza in 2004.

What I call the Netanyahu doctrine is based on geographic, institutional, and even mental separation between Israel as a globalized economy and Israel as a state that occupies a territory and engages in a territorial conflict. Elsewhere I have called this doctrine “hawkish neoliberalism,” a doctrine based on the premise that free markets must be harnessed to serve the national purpose.

Is the Netanyahu Doctrine Sustainable?

The greatest blind spots of the Netanyahu doctrine are its domestic social costs. During the 2000s, inequality and poverty rates rose. Investment in education, public health, development, and infrastructure declined. From the perspective of Netanyahu and his camp, the domestic costs were a fair price to pay for sustaining Israel’s position in the international sphere.

After the global financial crisis of 2008 and the social justice protests inside Israel in the summer of 2011, Israel’s economy was partly rebalanced to restore some social spending. However, Israel still lags behind in terms of public investment among the countries belonging to the Organization for Economic Cooperation and Development.

The future of the Netanyahu doctrine also depends on the course of the Israel–US relationship because Israel remains significantly dependent on the US. Israel’s ability to forge independent relations with China and Russia has limits due to US concerns with technology transfer. It could be the case that after Russia’s war in Ukraine, a revitalized West led by the US will pressure Israel to realign its foreign policy, despite its increased financial independence.